Walmart Inc.’s global supply chain and operations management expertise are strategic resources in its value chain to keep competitive advantages in the international retail industry. Such competitive advantages are identified in this VRIO and VRIN analysis and value chain analysis of the company, within the resource-based view (RBV). Derived from Jay B. Barney’s framework, the VRIO analysis is a strategic management and strategic planning tool to inform decision makers about the organizational resources and capabilities that support long-term competitive advantages. The VRIN framework uses non-substitutability (N in VRIN) instead of organization (O in VRIO) in determining which resources and capabilities are core competencies for sustained competitive advantages. This internal analysis of Walmart Inc.’s business determines VRIN and VRIO competitive advantages against other retailers, such as Amazon, Costco, Home Depot, and Target, as well as content delivery service providers, including Apple, Netflix, and Google. Walmart’s value chain is analyzed with regard to the firm’s core competencies. Some of these core competencies are directed against competitors with major online operations. This strategic focus addresses market shifts toward e-commerce. Walmart’s strategic objectives suit current business conditions by exploiting the corporation’s competitive advantages for optimal value chain and operational effectiveness.

Walmart Inc. VRIO & VRIN Analysis, Table (Resource-Based View)

Competitive advantages buttress Walmart’s business performance. However, the company needs additional competencies to protect its retail business against aggressive and disruptive competitors. In this VRIN/VRIO analysis case, the following resources and capabilities are the bases for Walmart’s sustainable competitive advantages or core competencies:

| Walmart’s Organizational Capabilities & Resources | V | R | I | O | N |

| Non-core Competencies: | |||||

| – Easy access to adequate human resources | ✔ | ||||

| – Diverse product offerings | ✔ | ||||

| – Broad set of private label brands | ✔ | ✔ | |||

| – High-potential package delivery network | ✔ | ✔ | |||

| Sustained Competitive Advantages: | |||||

| – Inventory management systems set up for high efficiency | ✔ | ✔ | ✔ | ✔ | ✔ |

| – Strong brand value | ✔ | ✔ | ✔ | ✔ | ✔ |

| – Strong bargaining power based on organizational size | ✔ | ✔ | ✔ | ✔ | ✔ |

| – Vast international supply chain | ✔ | ✔ | ✔ | ✔ | ✔ |

| – Major e-commerce operations | ✔ | ✔ | ✔ | ✔ | ✔ |

| – Extensive access to consumer data | ✔ | ✔ | ✔ | ✔ | ✔ |

| – Data analytics and data mining capabilities | ✔ | ✔ | ✔ | ✔ | ✔ |

* This VRIO/VRIN table is best viewed using HTML5-compatible browsers.

Non-core Competencies. As a retail business, Walmart Inc. has a workforce that generally does not require highly specialized skills. Consequently, easy access to adequate human resources is a competency considered in this VRIO/VRIN analysis. However, despite its value to the business, this resource is not rare, is easily imitable, and does not contribute long-term competitive advantage to fight Walmart’s competitors. Similarly, the company’s diverse products, set of private label brands, and package delivery network are organizational resources and capabilities that do not satisfy all the requirements, namely Value, Rarity, Inimitability, and Organization (VRIO framework), and Value, Rarity, Inimitability, and Non-substitutability (VRIN framework). These four resources/capabilities are non-core competencies that help strengthen Walmart’s value chain and competitive advantages. However, in the resource-based view, these non-core competencies cannot sustain such competitive advantages for long-term business growth and development.

VRIO Core Competencies (Long-Term Competitive Advantages) of Walmart. This VRIO analysis includes the company’s inventory management systems as a core competency for competitive advantage. In the resource-based view, these systems are a strategic resource developed specifically for Walmart Inc.’s needs, for minimized inventory bottlenecks and costs. These systems help the retail business maximize its profit margins. In addition, Walmart’s strong brand value is a core competency because it satisfies all of the VRIO variables. The brand is a valuable, rare, and difficult-to-imitate resource. To compete against other retailers, Walmart’s organization uses this brand throughout its operations, and applies it in the value chain to make it easy for consumers to identify places (brick-and-mortar and online) where affordable goods are accessible.

Strong bargaining power based on organizational size is another sustainable competitive advantage that helps Walmart fend off aggressive competitors. The resource-based view of the company considers this organizational capability as an enabler of the company in using cost leadership and low prices to compete, especially against smaller retailers that do not have the sales volume to compete based on price. This core competency empowers Walmart to compel manufacturers or suppliers to apply price reduction, which adds value as the goods move through the company’s value chain. According to the VRIO table, the company’s strong bargaining power is valuable, rare, and difficult to imitate. Organized around this core competency, Walmart requires manufacturers and suppliers to have low prices to benefit consumers and the business.

In addition, Walmart’s vast international supply chain is an organizational resource that creates sustainable competitive advantage, based on the VRIO analysis model. The supply chain supports the size of the company’s operations, the cost-leadership strategy, and low pricing, thereby ensuring an effective value chain. In the resource-based view of Walmart’s retail business, the supply chain is a long-term competitive advantage because it allows the company to access the cheapest or most competitively priced goods from manufacturers. Effective supply chain management directly contributes to Walmart’s value chain effectiveness that attracts buyers to its stores and e-commerce website.

In the VRIO framework, major e-commerce operations are viewed as a sustained competitive advantage of Walmart Inc. Now an e-commerce player, partly as a strategic response to Amazon.com Inc., Walmart’s investments in information technology and its high variety of product offerings contribute to competitiveness. This core competency is valuable (reinforces market reach and improves customer experience), rare (only a few firms can match e-commerce operations of this scale), and difficult to imitate (among smaller retailers). The company’s organization around this competency makes e-commerce operations a sustainable competitive advantage. In the resource-based view of Walmart Inc., e-commerce operations also optimize retail value chain efficiencies.

Extensive access to consumer data is another core competency evaluated in this VRIO analysis of Walmart Inc. The millions of consumers in the company’s multinational operations generate vast amounts of data about purchase behaviors. Through this organizational resource, Walmart forecasts fluctuations in demand, allowing managers to accurately respond to retail market changes, thereby maintaining value chain consistency. In relation, the data analytics and data mining capabilities included in this VRIO analysis empower Walmart to obtain high-value information from consumer data. The company is organized around using its consumer data resource, data analytics and data mining capabilities, and e-commerce operations. The combination of these technological capabilities creates synergistic and sustainable competitive advantage that is valuable, rare, and inimitable. In the resource-based view of Walmart’s operations, these strategic capabilities and resources are critical success factors in satisfying consumers’ needs. These technological capabilities contribute to Walmart’s operational effectiveness and ensure that the company’s value chain actually benefits consumers.

VRIN Resources and Capabilities of Walmart Inc. The VRIN framework requires that an organizational resource or capability must be valuable, rare, imperfectly imitable, and non-substitutable for it to be a core competency of the business organization. Walmart’s VRIO core competencies are also VRIN core competencies, as presented in the table above. For example, the company’s inventory management systems and e-commerce operations are non-substitutable in a practical way. Also, extensive access to Walmart’s consumer data and data analytics and data mining capabilities are VRIN resources and capabilities because their value cannot be easily matched with non-big-data substitutes. The company’s organizational size is another core competency under the VRIN analysis framework. Even though competitors like Amazon and Target are able to directly compete, Walmart Inc.’s size is a competitive advantage against the vast majority of retailers that are smaller in organizational size, operational scale, and market reach. The company’s value chain is optimized through these VRIN resources and capabilities.

Walmart Value Chain Analysis: How the VRIN/VRIO Resources and Capabilities Relate to the Value Chain

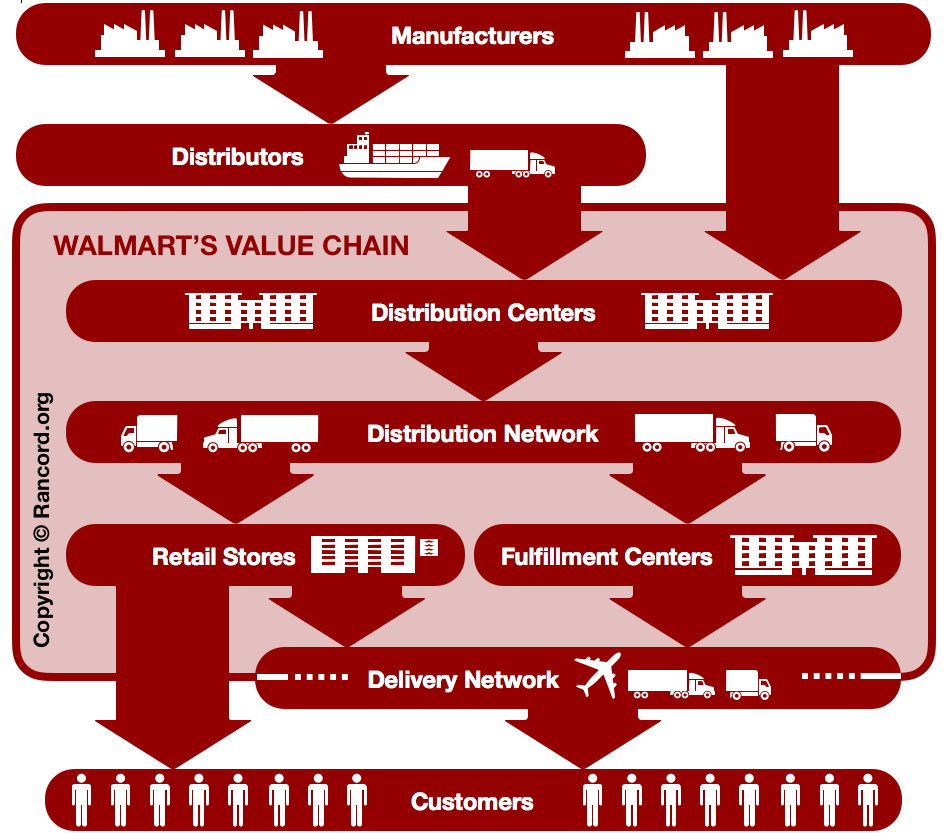

In analyzing Walmart’s value chain, the creation and provision of value to target consumers are linked to the core competencies identified through the VRIO and VRIN analysis frameworks. These competencies allow the company to add value to the goods that come from manufacturers or suppliers. The movement of these goods involves Walmart’s value-adding logistics and retail operations, illustrated in the following value chain diagram:

The above diagram depicts the retail industry value system and how Walmart’s value chain relates with the other components of this system. An industry value system is the set of all value chains involved in the industry, which in this case is the retail industry. According to Michael E. Porter, strategic business units determine the activities involved in the value chain. In this internal analysis case of Walmart Inc., these business units include the distribution centers, distribution network, fulfillment centers, retail stores, and delivery network represented in the value chain diagram. Through the supply chain, goods are moved from manufacturers and distributors to the company’s value chain. These goods exit Walmart’s value chain and reach the target customers, who are the consumers in the retail market. The delivery network is used in e-commerce operations where customers opt to have their purchased goods delivered. The network involves Walmart’s delivery operations as well as the operations of delivery service providers like FedEx. The network is a link or interface between the company and its target customers. The delivery network is only partially in Walmart’s value chain.

In moving goods through Walmart’s value chain, competitive advantage is created by using the company’s core organizational resources and capabilities, as assessed through the VRIN/VRIO analysis of the retail business. Such competitive advantage equates to reaching the company’s value proposition, which is to provide conveniently accessible and affordable goods to consumers. In the resource-based view of Walmart Inc., the core competencies are utilized in every step of the value chain. For example, the company’s strong bargaining power adds value for consumers by minimizing costs and prices. In addition, Walmart’s e-commerce operations add value by increasing the convenience of purchasing affordable goods. Also, the company uses its inventory management systems as a strategic resource for supply chain management, which determines costs and availability of goods to consumers. Thus, in light of the resource-based view, this value chain is a set of processes where Walmart Inc. utilizes its VRIO/VRIN resources and capabilities. Through this value chain, the company gains profits and the consumer benefits from low-cost goods that are convenient to access through Walmart’s stores and e-commerce website.

Key Points from the VRIN/VRIO Analysis and Value Chain Analysis of Walmart Inc.

Walmart has at least seven sustainable competitive advantages, which are shown in the VRIO/VRIN analysis table. The non-core competencies are organizational resources and capabilities that the retail business uses to protect its market share from further erosion due to competition. The aggressiveness of various online retailers, especially Amazon, threatens Walmart’s online and non-online revenues. In the resource-based view of the retail business, these non-core competencies may create advantages, but not necessarily for the long-term, as other retailers can employ the same strategic approaches and develop similar non-core competencies. Walmart Inc. needs to maintain a competitive and effective value chain by building up these strategic resources and capabilities, create new ones (such as through new ventures or acquisitions), and establish better synergies among them.

Some Recommendations. E-commerce and online shopping continues to rise. Thus, Walmart should continue expanding its strategic resources and capabilities relevant to online retail. For example, the company can improve its supporting services to maximize its e-commerce expansion. This VRIO/VRIN analysis and value chain analysis show that Walmart already has a high-potential package delivery network. However, this network is not yet comprehensive in reaching all target customers in markets where the company already operates. To improve Walmart’s value chain, it is essential to continue expanding the delivery network. Also, the corporation can integrate its information technology capabilities into this network to make it difficult to imitate. In the resource-based view, this strategic action can make the high-potential package delivery network a new sustainable competitive advantage that fulfills the VRIO requirements and VRIN requirements for Walmart’s core competencies.

References

- Barnes, S. J. (2002). The mobile commerce value chain: analysis and future developments. International Journal of Information Management, 22(2), 91-108.

- Bose, N. (2018). Walmart expands home delivery in fight with Amazon. Reuters.

- Chatzoglou, P., Chatzoudes, D., Sarigiannidis, L., & Theriou, G. (2018). The role of firm-specific factors in the strategy-performance relationship: Revisiting the resource-based view of the firm and the VRIO framework. Management Research Review, 41(1), 46-73.

- Cheng, A. (2018). Walmart’s E-commerce Tactics Against Amazon Look To Be Paying Off. Forbes.

- Craighead, C. W., & Shaw, N. G. (2003). E-commerce value creation and destruction: a resource-based, supply chain perspective. ACM SIGMIS Database: The DATABASE for Advances in Information Systems, 34(2), 39-49.

- Crain, D. W., & Abraham, S. (2008). Using value-chain analysis to discover customers’ strategic needs. Strategy & Leadership, 36(4), 29-39.

- Dekker, H. C. (2003). Value chain analysis in interfirm relationships: A field study. Management Accounting Research, 14(1), 1-23.

- Dutta, D. (2013). Path Dependence, VRIN Resource Endowments, and Managers: Towards an Integration of Resource-Based Theory and Upper Echelons Theory. Journal of Business Theory and Practice, 1(1), 109-118.

- Ensign, P. C. (2001). Value chain analysis and competitive advantage. Journal of General Management, 27(1), 18-42.

- Fearne, A., Garcia Martinez, M., & Dent, B. (2012). Dimensions of sustainable value chains: implications for value chain analysis. Supply Chain Management: An International Journal, 17(6), 575-581.

- International Trade Administration – U.S. Department of Commerce – The Retail Services Industry in the United States.

- Kim, S. C., Lee, J. S., & Shin, K. I. (2015). The impact of project management assets on the VRIO characteristics of PM process for competitive advantage. International Journal of Productivity and Quality Management, 15(2), 153-168.

- Lopes, J., Farinha, L., Ferreira, J. J., & Silveira, P. (2018). Does regional VRIO model help policy-makers to assess the resources of a region? A stakeholder perception approach. Land Use Policy, 79, 659-670.

- Maxham III, J. G., Netemeyer, R. G., & Lichtenstein, D. R. (2008). The retail value chain: linking employee perceptions to employee performance, customer evaluations, and store performance. Marketing Science, 27(2), 147-167.

- Rosenblatt, B. (2018). Apple And Walmart Inject New Life Into Sleepy E-Book Market. Forbes.

- Siebers, L. Q., Zhang, T., & Li, F. (2013). Retail positioning through customer satisfaction: an alternative explanation to the resource-based view. Journal of Strategic Marketing, 21(7), 559-587.

- Talaja, A. (2012). Testing VRIN framework: Resource value and rareness as sources of competitive advantage and above average performance. Management: Journal of Contemporary Management Issues, 17(2), 51-64.

- Walmart Inc. – All Departments.

- Walmart Inc. – FedEx Office Pickup.

- Walmart Inc. – Our Business.

- Walmart Inc.’s Annual Report to the U.S. Securities and Exchange Commission (Form 10-K).

- Who is Parcel? What This Delivery Company Means to Walmart.

- Wu, L., & Chiu, M. L. (2015). Organizational applications of IT innovation and firm’s competitive performance: A resource-based view and the innovation diffusion approach. Journal of Engineering and Technology Management, 35, 25-44.