Bank of America Corporation’s (BofA/BoA) core competencies, based on the VRIO framework and VRIN framework, ensure the company’s value chain and its competitive advantages against other firms, such as JPMorgan Chase, Citigroup, and Wells Fargo. Using the resource-based view (RBV), the VRIO/VRIN analysis model identifies the most significant competencies (resources and capabilities) in strategic planning processes, based on a number of criteria, such as value, rarity, imperfect imitability, and organization (VRIO), and value, rarity, imperfect imitability, and non-substitutability (VRIN). In this business analysis case of Bank of America, these frameworks determine how the enterprise maintains its competitive power, despite challenges in the industry environment. The company’s value chain uses these competitive advantages in satisfying its value proposition to target customers in the global financial services market. Thus, Bank of America’s value chain effectiveness partly depends on the company’s VRIO/VRIN core competencies and competitive advantages.

In strategic management and long-term strategic planning, the VRIO analysis, VRIN analysis, and value chain analysis of Bank of America Corporation provide insights on how resources and capabilities function as core competencies that create or support the company’s competitive advantages. This resource-based view of the company informs strategic objectives, and allows a competitive power test for a comparative assessment of the business and its competitors in the financial services industry. The results of such analytical evaluation guide strategies for achieving Bank of America’s corporate vision and mission statements.

Bank of America VRIO Analysis & VRIN Analysis (Resource-Based View)

| ORGANIZATIONAL RESOURCES & CAPABILITIES | V | R | I | O | N |

| Competitive Parity or Equality: | |||||

| Integrated information technologies for online banking | ✔ | ||||

| Unexploited Competitive Advantages: | |||||

| Resource capacity for diversification | ✔ | ✔ | ✔ | ||

| Sustained Competitive Advantages: | |||||

| Branding of Bank of America, especially in commercial banking | ✔ | ✔ | ✔ | ✔ | ✔ |

| Expertise in financial services | ✔ | ✔ | ✔ | ✔ | ✔ |

| Bank of America’s multinational organizational size | ✔ | ✔ | ✔ | ✔ | ✔ |

- This VRIO/VRIN analysis table is best viewed using HTML5-compatible browsers.

Non-core Competencies. In the resource-based view, Bank of America’s non-core competencies are resources and capabilities that affect competitiveness, but do not ensure the company’s competitive advantage. These competencies fail to satisfy at least one of the requirements of the VRIN/VRIO framework pertaining to financial services business operations. Although these non-core competencies influence Bank of America’s value chain (see Value Chain analysis section below), they have minimal or insignificant contribution to business competitive advantages against other financial services firms. For example, Bank of America’s online banking information technologies provide only competitive parity (or competitive equality) because other banks have similar technologies. This VRIN/VRIO analysis also identifies the company’s resource capacity for diversification into industries that could complement current operations in investment banking, wealth management, and commercial banking, including subsidiaries like BofA Securities (formerly Bank of America Merrill Lynch). Such resource and capability is a non-core competency because Bank of America continues to focus primarily on financial services. Based on the VRIO/VRIN analysis, this capacity has insignificant contribution to the competitive advantages of the banking business.

VRIO Analysis of Bank of America’s Core Competencies (Sustainable Competitive Advantages). The VRIO analysis table shows that the core competencies depend on human resources and organizational design and development strategies of the financial services enterprise. For example, Bank of America’s brand is a resource that functions as a core competency that satisfies all of the criteria of the VRIO analysis framework. In the resource-based view, the brand provides long-term or sustained competitive advantage by making the company’s financial services easily recognizable among target customers. In relation, industry-specific human resource expertise is a core competency that adds to Bank of America’s competitive power, especially against smaller firms’ value chains. Moreover, the banking company’s large multinational organizational size is considered a core competency based on the VRIO analysis model. A large international footprint gives leverage and competitive advantage that makes Bank of America stronger against competitors that use a cost-leadership strategy and/or a market penetration growth strategy. All of these core competencies satisfy the VRIO criteria pertaining to financial services: valuable, rare, inimitable/imperfectly imitable, and organized. These resources and capabilities support Bank of America’s generic strategy for competitive advantage, business model, and intensive strategies for growth. The core competencies identified in this VRIO analysis relate to the company’s strategic plans and strategic objectives for growing the business and enhancing its value chain in the global financial services market.

VRIN Analysis of Bank of America’s Core Resources & Capabilities. The VRIN analysis table indicates that the company’s core competencies are also the ones that satisfy the VRIO framework. The three core competencies are the sources of sustained or long-term competitive advantages for Bank of America, based on the VRIN framework. For example, the company’s brand is a resource that satisfies the “N” or non-substitutability criterion of the VRIN framework, considering that there is no substitute for this brand’s business value. Similarly, expertise in financial services is a non-substitutable capability that gives competitive advantage to Bank of America’s value chain. In the resource-based view, the pooling of such expertise provides competitive power against smaller banking firms that do not have the same combined expertise in their human resources. This VRIN analysis further indicates that Bank of America’s organizational size and multinational reach are a core competency. This organizational size is a resource and capability for withstanding aggressive competition, by virtue of the risk capacity of a large business organization. Such a core competency is specific to this VRIN analysis, considering the nature of Bank of America and the financial services industry. The business strengths enumerated in the SWOT analysis of Bank of America Corporation are directly related to these core competencies that satisfy the VRIN analysis framework. The strengths illustrate the importance of the VRIN test in understanding how the business organization develops and maintains its value chain and competitive advantages.

Value Chain Analysis of Bank of America: VRIN/VRIO Resources & Capabilities in the Value Chain

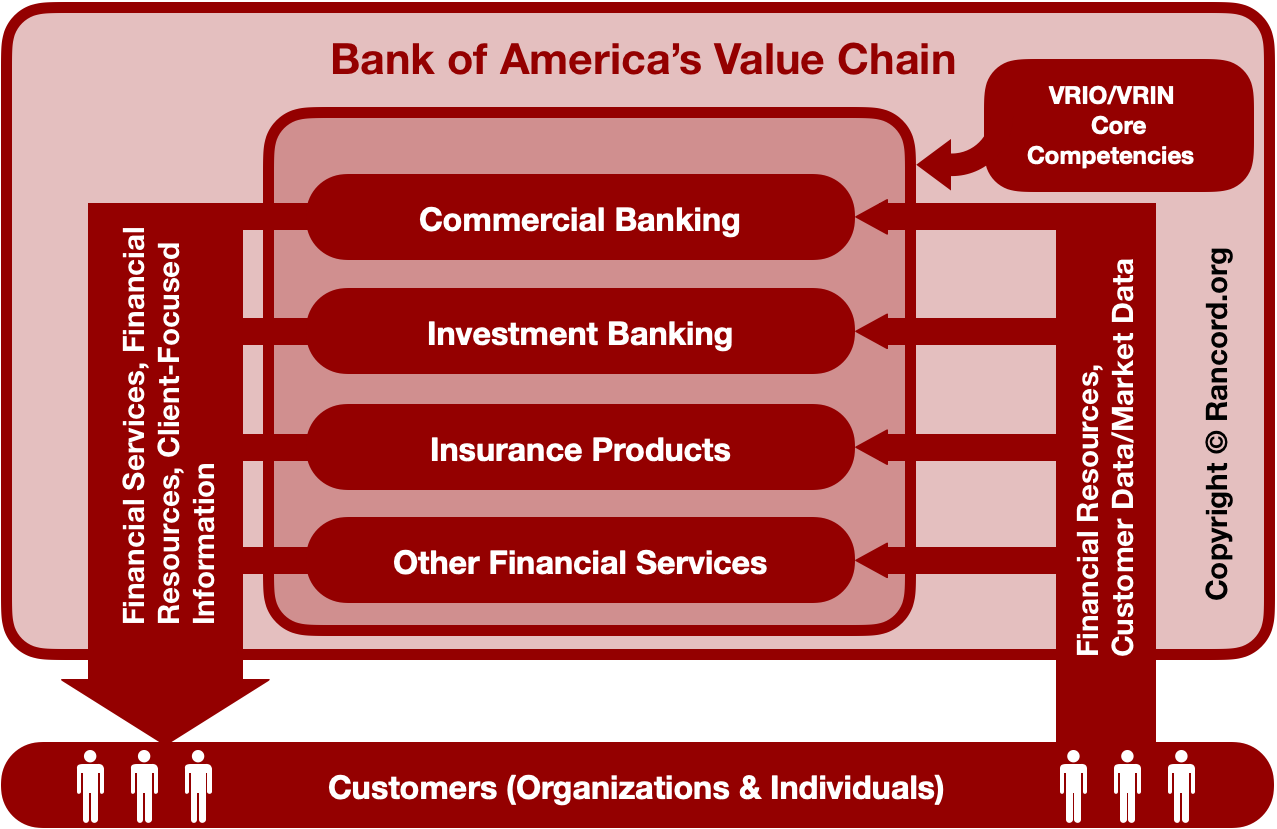

Bank of America’s value chain is a system of financial service processes that create value for customers. For example, based on the value proposition of making financial lives better, the company’s value chain connects clients to resources using the VRIN/VRIO core competencies. The following diagram is based on a value chain analysis of Bank of America Corporation:

In the above diagram, the value chain analysis of Bank of America provides a general perspective of how the business operates, and how value is created using the core competencies identified through the VRIO/VRIN analysis model. The banking company’s value chain has a “circular” form, with inflow from customers to the business, and outflow from the business to the same population of customers, including depositors and investors. This form is based on the fact that Bank of America’s customers are the sources and recipients of financial resources. For example, the company pools funds and makes them available to customers, such as through loans. This circular form reflects an aspect of Bank of America’s supply chain. However, the company’s actual supply chain management involves other business areas, such as information technology procurement for online banking operations management. In the diagram, the financial and data inputs to Bank of America’s value chain are transformed using VRIN/VRIO core competencies, such that the organizational output (financial services and resources) is valuable to customers. The value-creating financial service processes in the value chain depend on the core resources and capabilities. Bank of America’s corporate structure formalizes the groupings and system of activities necessary to maintain this value chain. The organizational structure, value chain (and supply chain), and the core competencies identified in the VRIN/VRIO analysis are interrelated in building the company’s competitive advantages.

Key Points from the VRIN/VRIO Analysis and Value Chain Analysis of Bank of America Corporation

The VRIO analysis of Bank of America Corporation determines three core competencies. These competencies are the resources and capabilities that contribute to the banking company’s competitive advantage. The VRIN analysis of Bank of America Corporation identifies the same business resources and capabilities as the VRIO core competencies. These results illustrate the similarity between the VRIO analysis framework and the VRIN analysis framework. On the other hand, the value chain analysis of Bank of America Corporation presents how these core resources and capabilities apply in business operations. This application links the resource-based view to the financial services business value chain. A supply chain analysis of Bank of America can offer additional insights on the value chain and the company’s competitive advantages. The company’s supply chain management influences this value chain. Also, Bank of America’s organizational culture affects how human resources utilize these VRIO/VRIN core competencies for value chain and operational effectiveness. The company’s competitive advantages are subject to the capabilities of the workforce, thereby indicating the importance of human resources and the core competencies identified in the VRIN/VRIO analysis.

References

- Bank of America Corporation – Mobile and Online Banking Benefits and Features.

- Bank of America Corporation – Our Business Practices – Client Focus.

- Bank of America Corporation – Our Company – Our Strategy.

- Bank of America Corporation’s Annual Report for the U.S. Securities and Exchange Commission (Form 10-K).

- Barney, J. B. (2017). Resources, capabilities, core competencies, invisible assets, and knowledge assets: Label proliferation and theory development in the field of strategic management. The SMS Blackwell Handbook of Organizational Capabilities, 422-426.

- Cachon, G. P., & Netessine, S. (2006). Game theory in supply chain analysis. In Models, Methods, and Applications for Innovative Decision Making (pp. 200-233). INFORMS.

- Cho, D. W., Lee, Y. H., Ahn, S. H., & Hwang, M. K. (2012). A framework for measuring the performance of service supply chain management. Computers & Industrial Engineering, 62(3), 801-818.

- Dekker, H. C. (2003). Value chain analysis in interfirm relationships: A field study. Management Accounting Research, 14(1), 1-23.

- Hossan Chowdhury, M. (2011). Ethical issues as competitive advantage for bank management. Humanomics, 27(2), 109-120.

- Huggins, R., & Izushi, H. (Eds.). (2011). Competition, competitive advantage, and clusters: The ideas of Michael Porter. Oxford University Press.

- International Trade Administration of the U.S. Department of Commerce – The Financial Services Industry in the United States.

- Kaplinsky, R. (2000). Globalisation and unequalisation: What can be learned from value chain analysis? Journal of Development Studies, 37(2), 117-146.

- Lin, C., Tsai, H. L., Wu, Y. J., & Kiang, M. (2012). A fuzzy quantitative VRIO-based framework for evaluating organizational activities. Management Decision, 50(8), 1396-1411.

- Scholtens, B. (2016). Corporate social responsibility in the bank value chain. In Sustainable Value Chain Management (pp. 481-500). Routledge.

- Sun, J., Wang, C., Ji, X., & Wu, J. (2017). Performance evaluation of heterogeneous bank supply chain systems from the perspective of measurement and decomposition. Computers & Industrial Engineering, 113, 891-903.

- Talaja, A. (2012). Testing VRIN framework: Resource value and rareness as sources of competitive advantage and above average performance. Management-Journal of Contemporary Management Issues, 17(2), 51-64.